In December 2022, the Canadian government enacted new legislation into the Income Tax Act which significantly broadens requirements for trusts to file tax returns (which were previously exempt from filing) and for all trusts to disclose additional information about the trust to the Canada Revenue Agency (“CRA”). Trustees should anticipate increased reporting requirements and potentially […]

Tax Updates

Tax Update: End-of-Year Tax Considerations

- Some End-of-Year Tax Considerations

- Underused Housing Tax Penalties Now Applicable

- Extension of Deadlines for CEBA Loan Repayment

- Change to Corporate Paper Filing Limit

Tax Update: Moving Expenses – Overlooked Tax Expense

- Moving Expenses – Overlooked Tax Expense

- Getting CRA To Waive or Cancel Penalties and Interest

- CRA Terminating 120 Employees for CERB Violations – Agency Employees Do Make Mistakes, Options Exist, If Aggrieved, Do Consult

- Around the Courts

Tax Update: You Can Be Liable for a Family Member’s Tax Debts

- You Can Be Liable for a Family Member’s Tax Debts

- A Tip If You Have a Corporation and No Employment Income

- Bare Trust and Nominee Agreements

- A Tax Tip When You Make Investments

- Should You File If You Can’t Pay?

- Around The Courts

Tax Update: Shareholder Remuneration

- Shareholder Remuneration: an Overview

- Mandatory Reporting Rules Now In Effect

- Around the Courts

Tax Update: The Family Business and the Capital Gains Exemption

- The Family Business and the Capital Gains Exemption

- Can You Borrow from Your RRSP Without Paying Tax on the Withdrawal?

- Taxable Benefit Updates, Including New Policies for Virtual Social Events

- Around the Courts

Tax Update: Tax Shelters Related Issues

- Tax Shelters Related Issues – Salient Points to Look Out for

- Liang V. the Queen is a Crucial Case to Understand Limitations of Tax Shelters

- Budget 2023 – Interesting Proposals and Potential Tax Increases

- Tax-Free First Home Savings Account – $40k Limit – Open FHSA Account from April 1, 2023

Tax Update: Residential Property Warning – Huge Penalties

- Residential Property Warning – Huge Penalties

- Bare Trust Dangers

- HST Quiz — Is Your Business Charging it Properly?

- Simplified Instalments if You Have the Cash

- Watch Out for Short Taxation Years

- Around the Courts

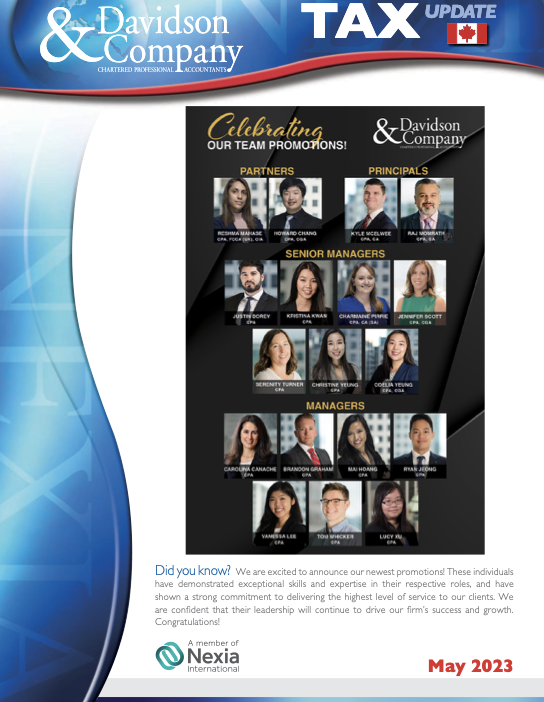

Tax Update + Celebrating Our New Partners!

- Celebrating Our New Partners

- Philanthropic New Year’s Resolutions

- The Hidden Benefits of Life Insurance

Tax Update: Shareholder Agreements

- Shareholder Agreements

- What If You Disagree With the CRA?

- Don’t Do Too Much Trading in your TFSA